days sales in inventory ratio interpretation

Ratio analysis is used to evaluate various aspects of a companys. The Days Sales Outstanding formula to calculate the average number of days companies take to collect their outstanding payments is.

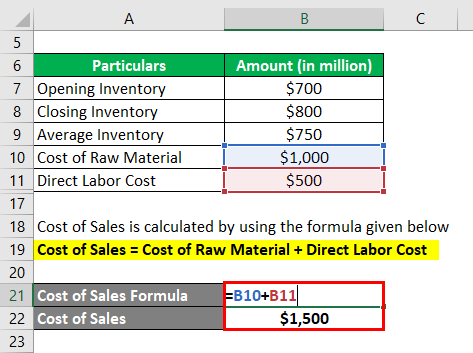

Days In Inventory Top 3 Examples Of Days In Inventory

A low turnover figure indicates that a business has an excessive investment in inventory and therefore is at risk of having obsolete inventory.

. A ratio analysis is a quantitative analysis of information contained in a companys financial statements. Let us consider the following Days Sales Outstanding example to understand the concept better. Interpretation of the Ratio.

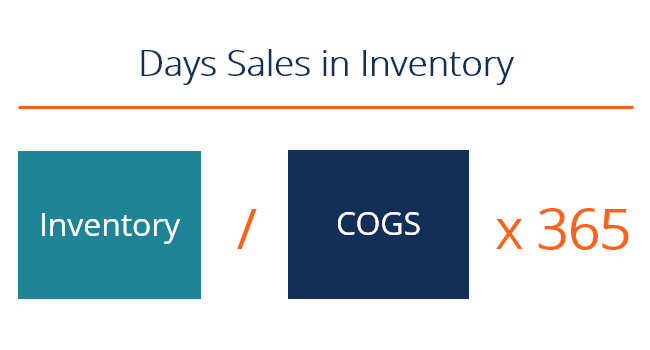

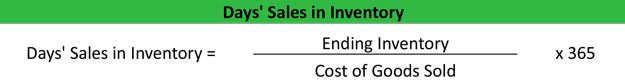

Calculates the time it takes to sell off inventory. Calculates the proportion of net profit to sales. A ratio of 1 is usually considered the middle ground.

Days Payable Outstanding Analysis Interpretation. Like the fixed asset turnover ratio the total asset turnover ratio is also affected by similar factors. The ratio is calculated as.

As a result Company B has a smaller CDR or DPO ratio. The average collection period is the approximate amount of time that it takes for a business to receive payments owed in terms of accounts receivable. Since the working capital ratio measures current assets as a percentage of current liabilities it would only make sense that a higher ratio is more favorable.

In this post Ive covered five key liquidity ratios. Sales to Capital Employed Ratio The sales to capital employed ratio examines how effectively the long-term capital employed of the business has been generating sales revenue. Coverage ratios for example debt-service coverage ratio and times interest earned ratio measure the ability of a company to make interest.

The main aim of treatment with antipsychotics is to reduce the positive symptoms of psychosis that include delusions and. Inventory management may have a substantial impact on a companys activity profitability liquidity and solvency ratios. The receivables turnover ratio is an absolute figure normally between 2 to 6.

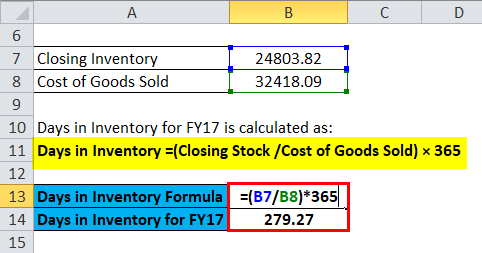

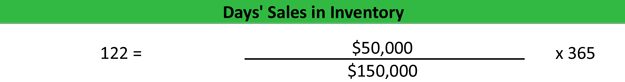

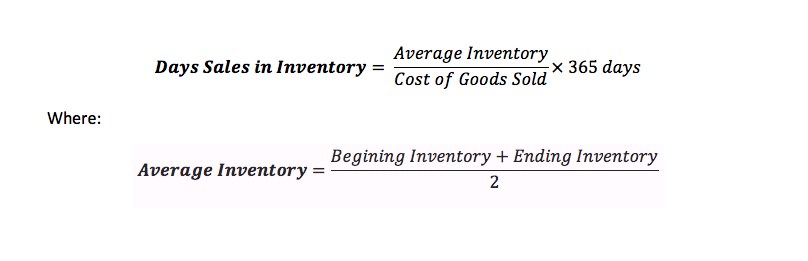

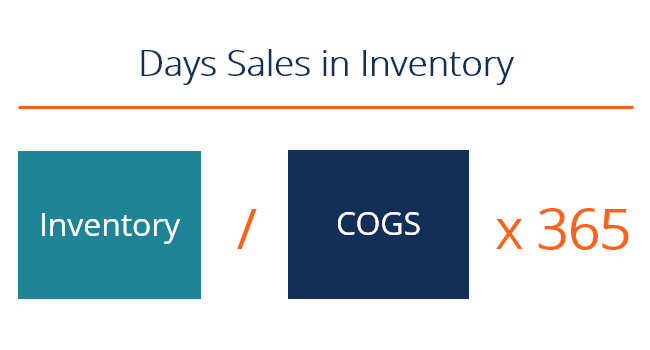

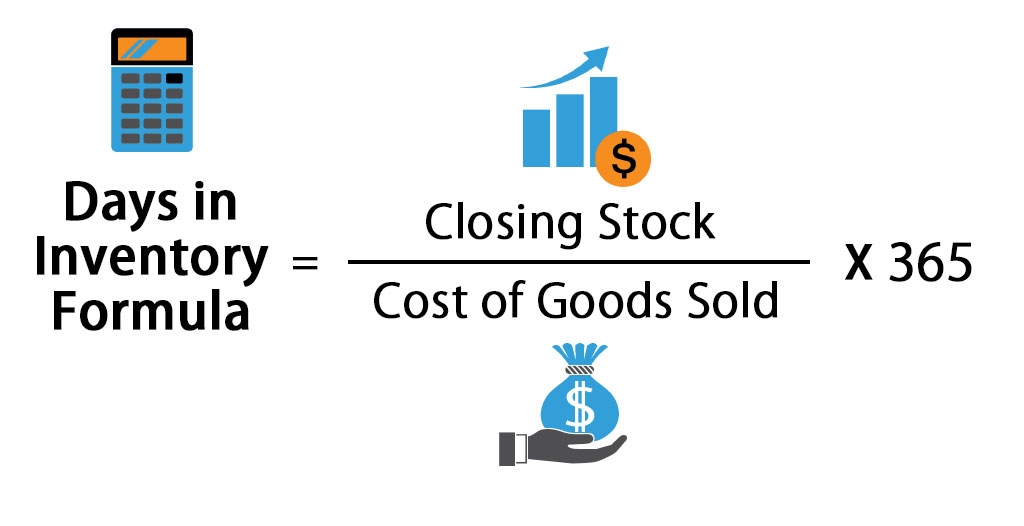

Is a ratio analysis measure to evaluate the number of days or time a company converts its inventory and other inputs into cash. The CDR for company B is 29 days and 365 days for company A. Thus Rons EBIT for the year equals 150000.

The inventory turnover ratio number of days of inventory ratio and gross profit margin ratio are useful in evaluating the management of a companys inventory. Here we discuss formula to calculate Days Payable Outstanding its interpretation practical industry examples. So what does that mean in practice.

This is known as the inventory turnover period. The inventory turnover ratio allows the financial manager to determine if the firm is stocking out of inventory or holding obsolete inventory. Investor Relations Todays IBM has defined a clear strategy to lead in the era of hybrid cloud and AI.

A WCR of 1 indicates the current assets equal current liabilities. Average Collection Period. Problems with the Inventory Turnover Formula.

Total Assets Turnover SalesAverage Total Assets. CARs statewide sales-price-to-list-price ratio was 100 percent in July 2022 and 1038 percent in July 2021. Current ratio quick ratio days sales outstanding operating cash flow ratio and cash ratio.

You can also divide the result of the inventory turnover calculation into 365 days to arrive at days of inventory on hand which may be a more understandable figure. Other liquidity ratios can be used such as a companys net debt net working capital as a. DSO Accounts ReceivablesNet Credit SalesRevenue 365.

This means that Ron has 150000 of profits left over after all of the cost of goods sold and operating expenses have been paid for the year. Antipsychotic drug treatment is a key component of schizophrenia treatment recommendations by the National Institute of Health and Care Excellence NICE the American Psychiatric Association and the British Society for Psychopharmacology. It considers the days inventory outstanding days sales outstanding and days payable.

What is inventory turnover ratio. Days Sales Outstanding Formula. Efficiency ratio example inventory turnover turnover ratio and days sales in inventory refer to how well the company generates sales and maximises profits while using its assets to liabilities.

Calculation of fair value. Also called the average collection period accounts receivableaverage sales per day this ratio allows financial managers to evaluate the efficiency with which the firm is. Receivables needed to maintain firms sales level.

Thus a turnover rate of 40 becomes 91 days of inventory. The ratio is calculated as follows. Average number of days until AR collected.

Average settlement period trade creditors credit purchases 365 days calculated to the nearest day. While Company B has higher trade creditors at the year-end it also has a higher cost of sales. General sales tax rate means a if the tax becomes payable before July 1 2013 7.

The purchaser owned the property for more than 30 days before it was brought into Manitoba. PG HA Average days inventory in stock 365 Inventory turnover Average number of days inventory held until sold. The median number of days it took to sell a California single-family home was 14 days in July and 8 days in July 2021.

The seller holds the property in inventory in Manitoba at the time of accepting the purchasers order. A receivable turnover ratio of 2 would give an average collection period of 6 Months 12 Months 2 and similarly 6 would give 2 Months 12 Months 6. Total PurchasesAverage Accounts Payables.

You can also use our Receivable Turnover Ratio Calculator. Of Days Payable Outstanding. The meaning is quite clear.

PG HA Inventory turnover Cost of goods sold COGS Average total inventory Liquidity of inventory Benchmark. A low proportion can indicate a bloated cost structure or. In order to calculate our EBIT ratio we must add the interest and tax expense back in.

:max_bytes(150000):strip_icc():gifv()/days-sales-inventory-dsi-final-f995b9bdd83f4c5a995b38576653fe02.png)

Days Sales Of Inventory Dsi Definition

What Is Inventory Turnover Inventory Turnover Formula In 3 Steps

Days Sales In Inventory Ratio Analysis Formula Example

Days In Inventory Formula Calculator Excel Template

Days Sales In Inventory Dsi Formula And Calculator Excel Template

Inventory Turnover Ratio Days Sales In Inventory The Two Restaurant Inventory Metrics That Will Help You Squash Food Cost Maximize Profits Apicbase

Inventory Days Double Entry Bookkeeping

Days Sales Outstanding Formula Meaning Example And Interpretation

Days Sales In Inventory Ratio Analysis Formula Example

Days Sales In Inventory Definition Formula Calculated Example Analysis

Days Sales Of Inventory Dsi Definition

Inventory Turnover Ratio Formula Meaning Example And Interpretation

Inventory Days Formula Meaning Example And Interpretation

Days Sales In Inventory Dsi Overview How To Calculate Importance

Days In Inventory Formula Calculator Excel Template

Inventory Days Formula Meaning Example And Interpretation

Days Sales Outstanding Dso Formula And Calculator Excel Template

Inventory Days Formula How To Calculate Days Inventory Outstanding

Days Inventory Outstanding Dio Formula And Calculator Excel Template